Renters, don't miss the chance to claim back your €500 Rent Tax Credit

- Daft.ie Insights

- Jan 13, 2023

- 3 min read

Updated: Jan 20, 2023

What is Rent Tax Credit? Who qualifies? How do I claim my Rent Tax Credit? And what information do I need to submit by claim? If these are questions you're wondering you've come to the right place! Below we have outlined all this detail for you and have included two handy infographics for you to use to help you with your claim.

What is Rent Tax Credit?

The rent tax credit was announced in Budget 2023 whereby renters will be due a tax credit relief of €500 up to €1,000. The rent tax credit will be available for 2022 until 2025 for renters. The amount of the credit is 20% of your rent payments in the year, up to a maximum of: €500 for an individual. €1,000 for a couple who are jointly assessed for tax.

You can claim the tax credit for rent paid in 2022 by making a tax return for 2022 from January 2023. (as we outline below in more detail to help you). You can claim the tax credit during the year for other years.

Who qualifies to get the Rent Tax Credit?

This Rent Tax Credit may be available for you if you pay rent for:

your principal private residence.

another property you use to facilitate your attendance at work or on an approved course.

a property used by your child to facilitate their attendance on an approved course.

How do I claim my Rent Tax Credit?

PAYE taxpayers should claim the rent tax credit due to them for the 2022 tax year by completing a Form 12 tax return using PAYE Services in myAccount.

To get started visit here and follow our step by step guide below on what to do:

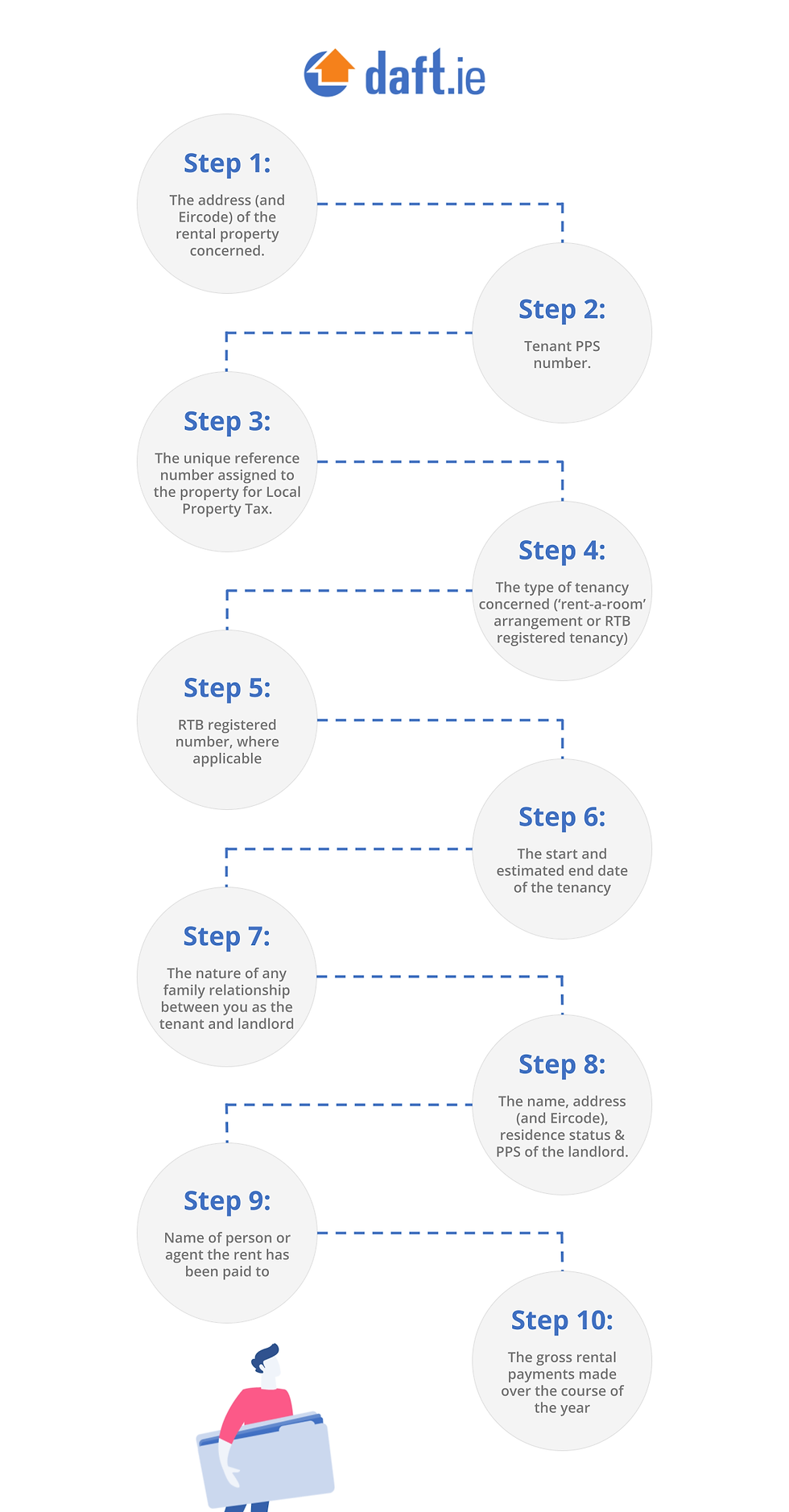

What information do I need to claim my Rent Tax Credit?

When making a claim for the rent tax credit you will be required to provide some information about the rental arrangement.

To make things easier for yourself we’d advise to have this info to hand before beginning the claims process (this info can usually be found on the tenancy agreement).

The info required is set out below:

You can check if a tenancy is registered on the RTB website here.

For anyone confused by the Gross amount of rent paid field and the credit due field and how this is calculated here’s an explanation. The credit due to you is equal to the lower of:

The total rent payments made by the claimant during the tax year at 20%, and

The specified amount at 20%.

The specified amount is €5,000 for a jointly assessed couple and €2,500 in all other cases. This means that the maximum rent tax credit due in a tax year is €1,000 for a jointly assessed couple (€5,000 x 20%), and €500 (€2,500 x 20%) in all other cases.

Example (provided by Revenue here)

Jane is a single person and made rent payments of €1,000 per calendar month throughout 2022 (€12,000 for the year 2022).

Jane’s income tax liability for the 2022 year of assessment, after all other credits, reliefs and allowances was €16,500.

Subject to all other conditions of the rent tax credit being met and a claim being made in that regard, Jane will be entitled to a credit of €500 in respect of the 2022 year of assessment, being the lower of:

€2,400 - the total of all rent payments made by Jane of €12,000 at 20%,

€500 - the specified amount of €2,500 at 20%, and

€16,500 - the amount required to reduce Jane’s income tax liability to nil.

For more examples and all other information please see the following Tax & Duty Manual created by Revenue here.

If additional assistance is required, you should contact Revenue’s PAYE helpdesk, contact details for which can be found here.

In Hollow Knight, players step into a vast underground world full of mystery. Every path leads to new enemies, hidden treasures, or unexpected challenges. Combat requires quick reflexes and smart movement. As you progress, you unlock special powers that help you reach new locations. The detailed environments and dark atmosphere make exploration exciting and unforgettable.

Thanks for sharing such valuable and informative content. The article is easy to follow and clearly focuses on facts rather than opinions. This makes it very helpful for readers seeking accurate knowledge. Debunked Daily is doing a great job by providing trustworthy information and encouraging informed discussions. Keep up the excellent work.

Another reason Geometry Dash remains popular is its strong connection between gameplay and music. Tracks still guide player movement, but modern levels use rhythm in more flexible ways—sometimes fast and intense, sometimes slow and atmospheric. This variety keeps the experience fresh for both new players and veterans.

In a digital age defined by complex gaming mechanics and ultra-realistic graphics, Snow Rider 3D stands out as a refreshing example of how simplicity can still captivate millions of players. Developed by DRA (a studio known for creating casual and accessible web-based games), Snow Rider 3D has become one of the most popular browser and mobile games in recent years.

Mapquest Directions helps users find the fastest routes to any destination, offering real-time traffic updates, turn-by-turn guidance, and multiple route options for efficient and stress-free travel planning.