Worrying signs from the housing market in Q3 – Ronan Lyons

- Daft.ie Insights

- Oct 3, 2016

- 3 min read

The figures in this latest Daft.ie Report show the continuing ill-health in Ireland’s housing market. Prices rose almost 3% between June and September, a rise that was only slightly smaller in Dublin (2.7%) than elsewhere (3.0%). It means that the year-on-year rate of inflation increased again, from a low of 6.1% in Q1 2016 to 7.6% in the third quarter.

The increase in annual inflation in Dublin – from 1.1% last quarter to 5.3% now – is particularly worrying. In part, it reflects a decline of 1.4% in the third quarter last year falling out of the calculation. But equally, it reflects the 2.7% increase in the last three months, the largest quarterly increase since early 2015.

This does not reflect the failure of the Central Bank rules. Rather, it reflects the underlying reason the rules were introduced in the first place. The rules were brought in to limit the potential for a severe imbalance between strong housing demand and very weak supply to damage the wider economy. However, those rules can only prevent damage through the financial system – a credit bubble, in effect.

There are other ways in which a dysfunctional housing market does wider damage, though. We have seen this clearly over the last five years, with growing homelessness of those who effectively fall out the bottom of the private rented sector and are forced to live in hotels and guesthouses. This is a symptom of social housing system that is simply not fit for purpose.

We know how a social housing system ought to work. It should give those who have insufficient incomes to cover the costs of their own accommodation enough of a top-up that they have somewhere to call home. This means it should be explicitly counter-cyclical: when the provision of market housing falls, the need for social housing rises. Tying the provision of social housing to market housing – as Ireland has done – makes no sense whatsoever.

The rise in prices recently – in both listings and in transactions – is not the only sign of a market under strain. Survey respondents now expect house prices to increase 4.7% over the next year, almost twice the expected increase six months ago. Transaction prices are now on average 2.2% above the initial listed price, compared to 1.5% above a year ago. And just 36% believe the market represents good value nationwide, down from 50% two years ago.

This is not to say that all aspects of the market are as bad. The number of transactions is holding up – with as many transactions recorded in the second quarter of 2016 as in the same period in 2015. The stock on the market has stabilised, while new building is picking up – albeit much slower than is needed.

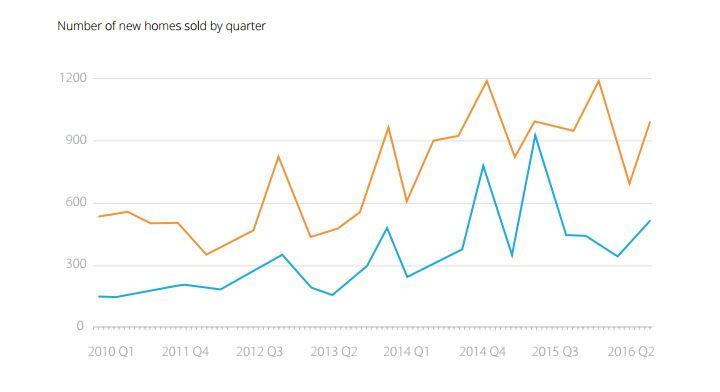

The graph shows the number of new homes sold each quarter, for Dublin (orange) and for the rest of the country (blue). The peak in sales in late 2014 (and again in mid-2015) represents a “cramming” of demand following the introduction of Central Bank rules. These outliers aside, it is clear that the trend over the last five years is upwards. For example, the number of new homes sold in Dublin in the first half of 2016 was 63% higher than in the first half of 2014. Elsewhere, the increase was smaller (15%) but the direction is still encouraging.

With this evidence, it is tough to argue that there is a compelling case for help for first-time buyers in the upcoming budget. This is particularly the case once the potential negative side-effects of further stimulating demand, in order to bring about more supply, are factored in. Indeed, anything that could be achieved – in terms of additional supply – by helping first-time buyers bid more against each other could also be achieved by lower the cost of building the typical home.

Politically, it may be necessary to be seen to be doing something to help first-time buyers. However, once the Budget passes, it will be time to focus on the far more important business of lowering construction costs in order to make new homes affordable for those on average incomes.

Comments